AgroApps Risk & Rate supports financial institutions during the process of assessing the credibility of a prospective borrower – agricultural business. It estimates future yields and discounts an enterprise inflow considering the cultivation plan per field, various climate change scenarios, as well as the cost of farming practices.

AgroApps Risk & Rate helps financial institutions to create a complete profile for every prospective borrower.

AgroApps Risk & Rate

Reinforce the risk assessment process of agricultural businesses

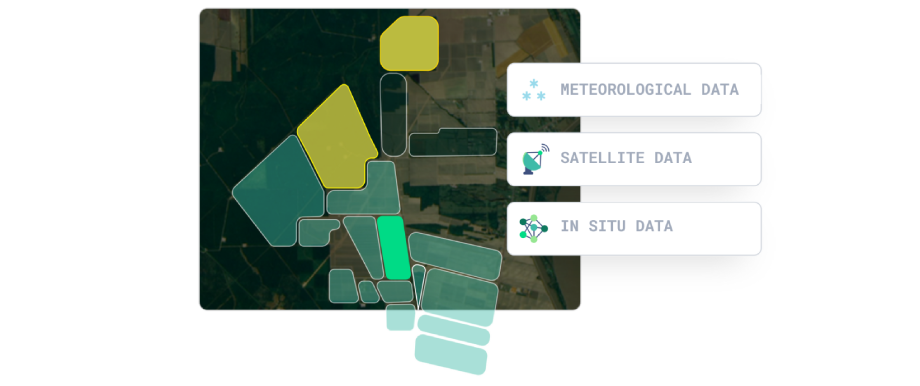

AgroApps Risk & Rate uses crop growth models, simulates biomass growth and estimates final yield, as affected from various future climate scenarios.

CREDIBILITY ASSESSMENT

ASSESSMENT OF CLIMATE RISKS FOR FARMS

ASSESSMENT OF CROP YIELDS

ESTIMATION OF FUTURE REVENUE & PROFITABILITY

ESTIMATION OF ENVIRONMENTAL FOOTPRINT

Credibility Assessment

AgroApps Risk & Rate gives the opportunity to financial institutions to assess the credibility of a prospective borrower based not only on their past financial data but, also, on their future inflow. Additionally, the institutions can assess the credibility of new clients who have no history of financial data available, and they are now starting their agricultural activity.

Assessment of Climate Risks for Farms

AgroApps Risk & Rate uses the climate scenarios related to planet temperature increase, as defined by the Intergovernmental Panel on Climate Change (IPCC). Based on these scenarios, the system estimates the inflow and assesses the financial risk resulting from the future climate variability.

Assessment of Crop Yields

AgroApps Risk & Rate predicts future crop yields by incorporating various factors such as the farm's size and location, crop type, cultivation plan for the entire loan repayment period, as well as climate scenarios.

Estimation of Future Revenue & Profitability

AgroApps Risk & Rate estimates future farm revenue and profit using the price indices of production coefficients. These estimates lead to comparative tables of crops on the basis of climatic scenarios and their impact on the farm revenue.

Estimation of Environmental Footprint

AgroApps Risk & Rate estimates CO2 emissions based on the cultivation plan of the prospective borrower. According to these estimates, financial institutions can now incorporate the environmental footprint in the overall farm assessment.

Tailor-made solutions that meet your needs

We focus on your special needs and recommend solutions that drive your business forward. Having an experienced team with high level of expertise, we invest a great deal of effort in research and advanced technologies; this enables us to design sustainable solutions for every farmer, enterprise, public or private agency active in digital farming.

Contact us